Home Price Crash? More Like Home Price Stabilization

At the end of last year, numerous housing experts proclaimed that there would be a home price crash in 2023. A few of these predictions included:

Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business:

“I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.”

Mark Zandi, Chief Economist at Moody’s Analytics:

“Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

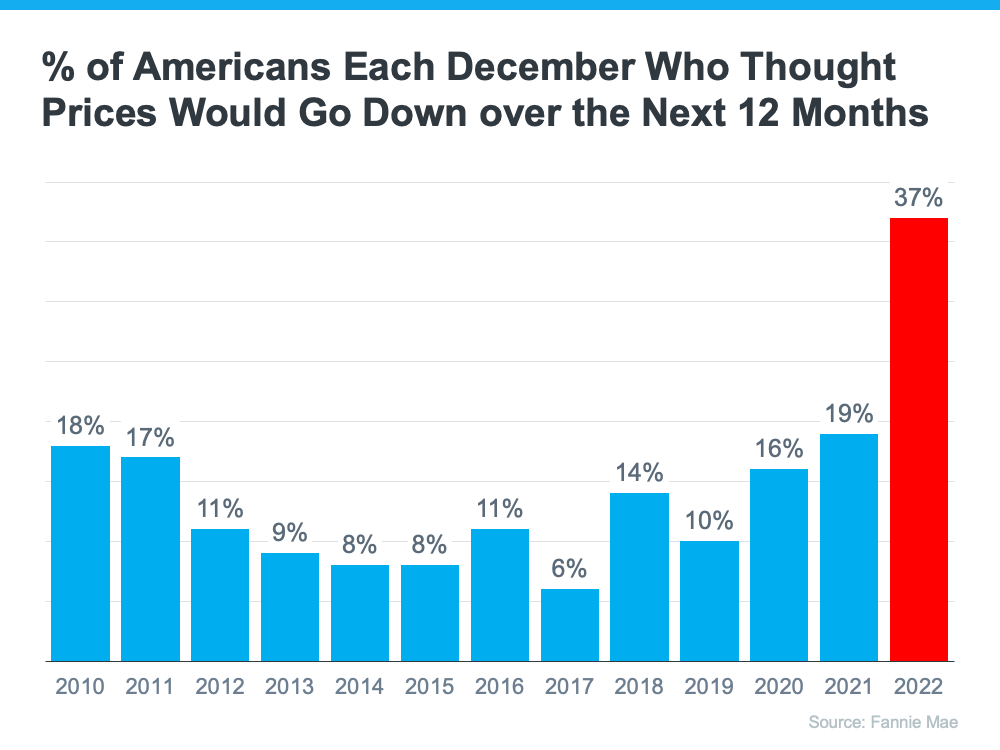

The Bad News: It Shook Consumer Trust

These forecasts disturbed many consumers, who started questioning the stability of the housing sector. The December Consumer Confidence Survey from Fannie Mae showed the largest proportion of Americans expecting house prices to dip within the next 12 months since the survey was established (see graph below). This made people hesitate when it came to making decisions concerning their home buying or selling plans in January.

The Good News: Home Prices Never Collapsed

Nevertheless, house prices did not crash and seem to be heading back up again following minor declines over recent months.

In a report just released, Goldman Sachs explained:

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S.,. . . ”

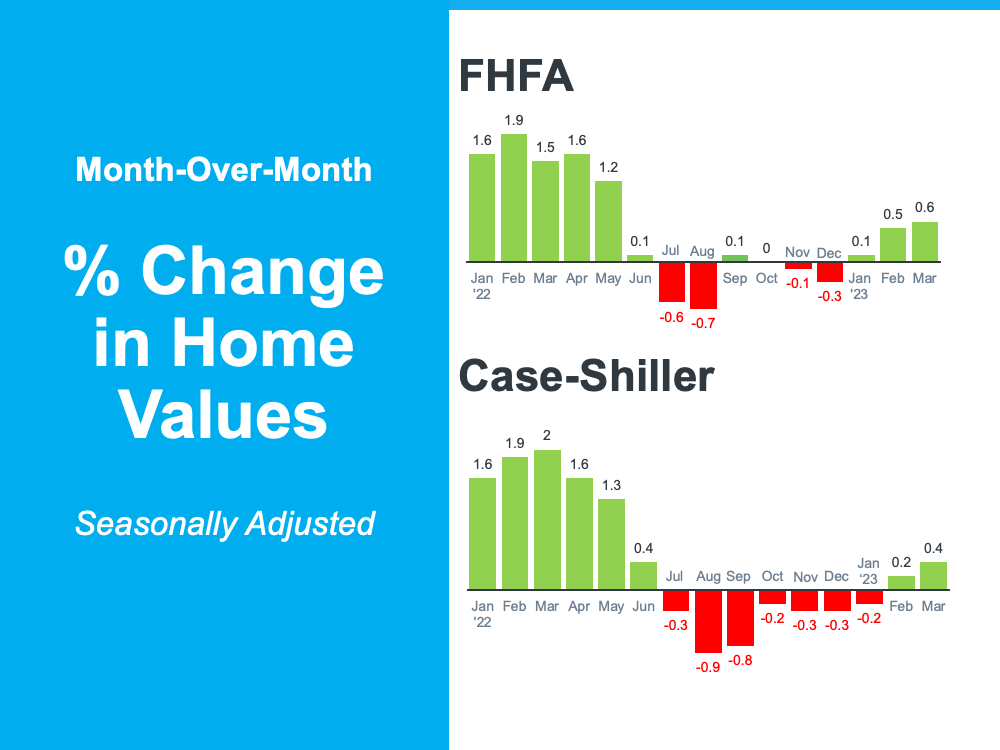

This was confirmed last week by two indexes on house prices: Case-Shiller and FHFA. Here are the figures they reported:

Home prices appear to have taken a turn for the better and are now on the rise again.

Bottom Line

When experts predicted that home values would plummet last autumn, they shouted it from the rooftops. The news spread across mass media platforms, industry newspapers, and podcasts.

Today, these same forecasters are whispering that the worst is over – but their predictions were not nearly as bad as initially thought. It falls upon us real estate professionals to point this out so that consumers can regain their sense of security in our market.