Homeownership: An American Dream?

The American Dream is a unique and personal construct. For many, it is linked to success, freedom, and prosperity – goals that can be attained through owning a home. Homeownership is a way of making progress toward the American Dream. It allows for greater security financially and more control over living space. By becoming a homeowner, individuals can take ownership of their lives and make progress towards the goals they set. Ultimately, homeownership is a powerful tool for achieving the American Dream.

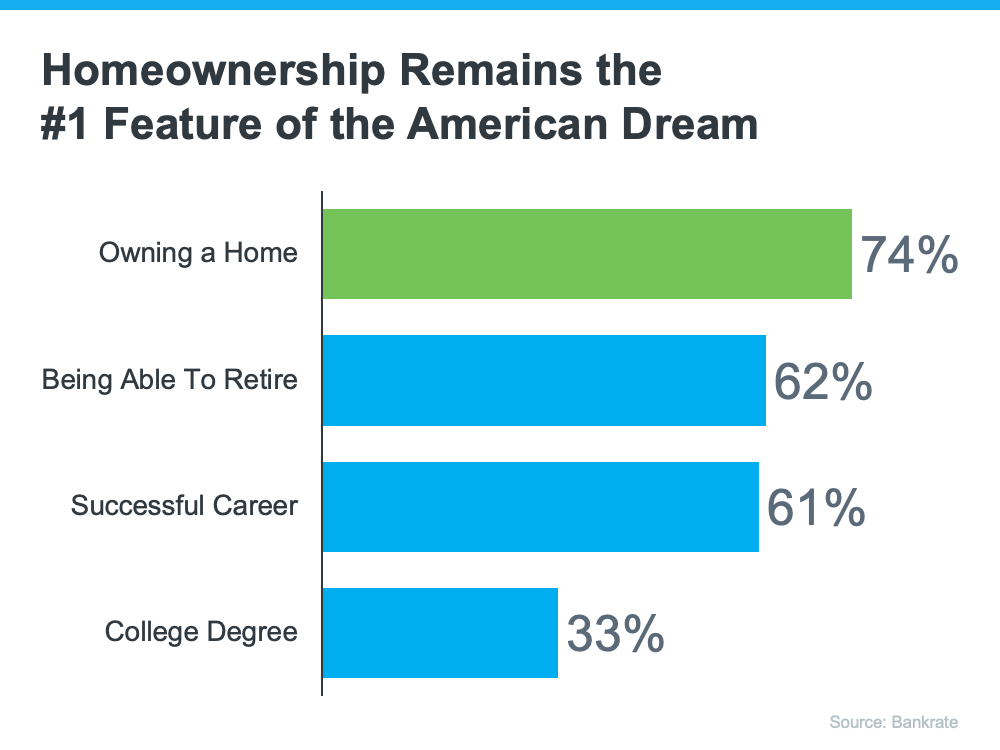

A survey from Bankrate asked people what they believed was part of the “American Dream”. The responses revealed that owning a home remains a priority for many (see graph):

As the graph shows, homeownership ranks above other significant milestones, including retirement, having a successful career, and earning a college degree.

A recent report from MYND helps shed light on why so many people value homeownership. It finds:

“. . . nearly two-thirds of Americans (65%) see homeownership as a means of building intergenerational wealth.”

Owning a home is an effective way to build equity and net worth. As you pay off the loan, your equity grows – plus, when home prices go up, so does your net worth. This helps create financial stability for generations to come.

Additionally, owning a home can provide significant tax benefits. Interest paid on a mortgage is typically tax deductible in the US, and property taxes are deductible as well. This can mean a lower tax bill each year.

Finally, owning a home provides stability and security for you and your family. You get the freedom to live in your own space however you choose with no landlord rules or restrictions. Plus, homeownership is often associated with increased levels of happiness overall.

To further drive home the difference homeownership can make in your life, a report from Fannie Mae says:

“Most consumers (87%) believe owning a home is important to ‘live the good life.’ . . . Notably, significantly more see ‘having less stress’ as a benefit achieved by owning than renting.”

Especially today, this could be because, when you own a home with a fixed-rate mortgage, you stabilize what’s likely your largest monthly expense (your housing cost), and that helps combat the impact of rising costs from inflation.

What Does This Mean for You?

We understand that it may feel challenging with higher mortgage rates and home prices today. But buying a home has many advantages. It’s an investment in your future, appreciation of equity, and the potential to build wealth. Homeownership also provides tax benefits, stability, pride of ownership, and the potential to save money on rent. Plus, it can be an opportunity to live in a great neighborhood with better schools and amenities. Incredible opportunities await you through homeownership

Bottom Line

In conclusion, homeownership is still considered an essential part of the American Dream and a key factor in building intergenerational wealth. It also offers long-term financial stability and gives you access to benefits that renting cannot provide. If now is the right time for you to make your dream of owning a home a reality, let’s connect today to start the process.