Real Estate Market Strength: This Is the Strongest of Our Lifetime!

When you look at the numbers, it’s clear that this housing market is incredibly strong. This could very well be the strongest housing market of our lifetime! Here are two fundamentals to prove it: 1) The current mortgage rate on existing mortgages and 2) The amount of homeowner equity. Let’s take a closer look at each one to see why this real estate market is so strong.

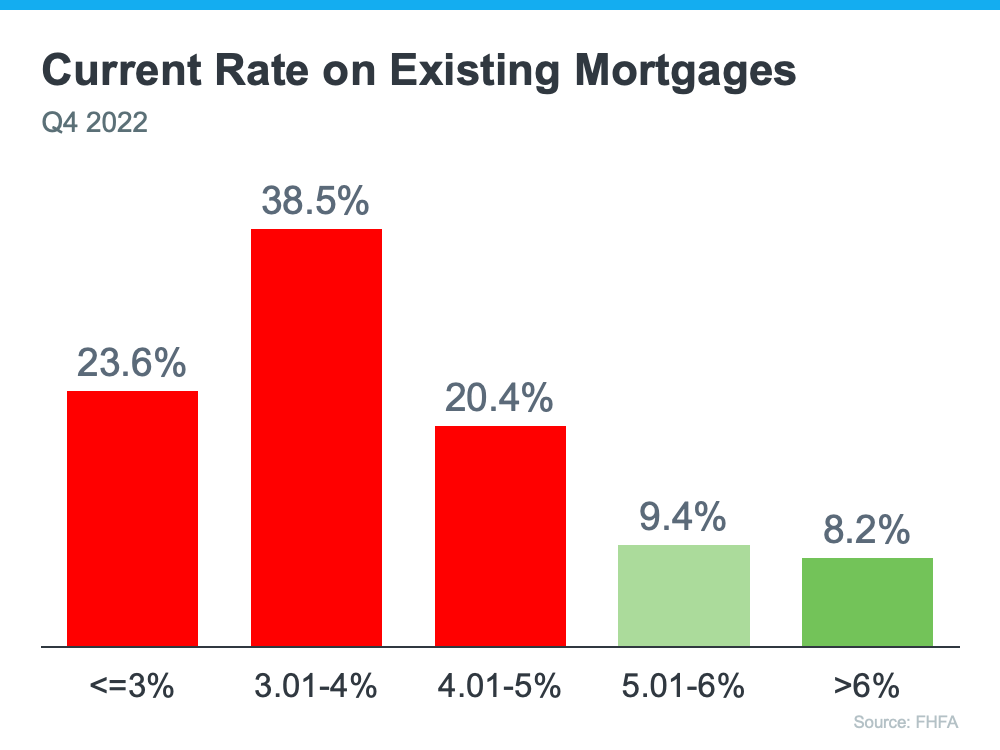

1. The Current Mortgage Rate on Existing Mortgages

First, let’s look at the existing mortgages rate. As per Federal Housing Finance Agency’s (FHFA) 4th quarter data, more than 80% of present mortgages have a rate that is lower than 5%. That’s an impressive feat. Plus, over 50% of mortgages have rates that are less than 4%, making this an extraordinary housing market (see graph below):

Now, there’s a lot of conversation in the media about potential foreclosures or defaulted mortgages, but here’s something to consider. Homeowners with such good mortgage rates are determined to keep their homes. They can’t go out and get another house or apartment that costs what they pay today – even if they downsize, it would be more expensive with today’s higher rates. That’s why these low mortgage rates provide a strong foundation for the housing market.

This shows us how much equity homeowners have built up over the past few years alone. And when homeowners have this amount of equity, it helps us avoid a wave of distressed properties coming onto the market as we saw during the crash. It also creates an extremely strong foundation for today’s housing market.

The current mortgage rate on existing mortgages is giving the housing market a solid foundation. By having so many homeowners with low mortgage rates, we can avoid any crisis of foreclosures coming to the market like in 2008. This gives us peace of mind and stability for investing in real estate today.

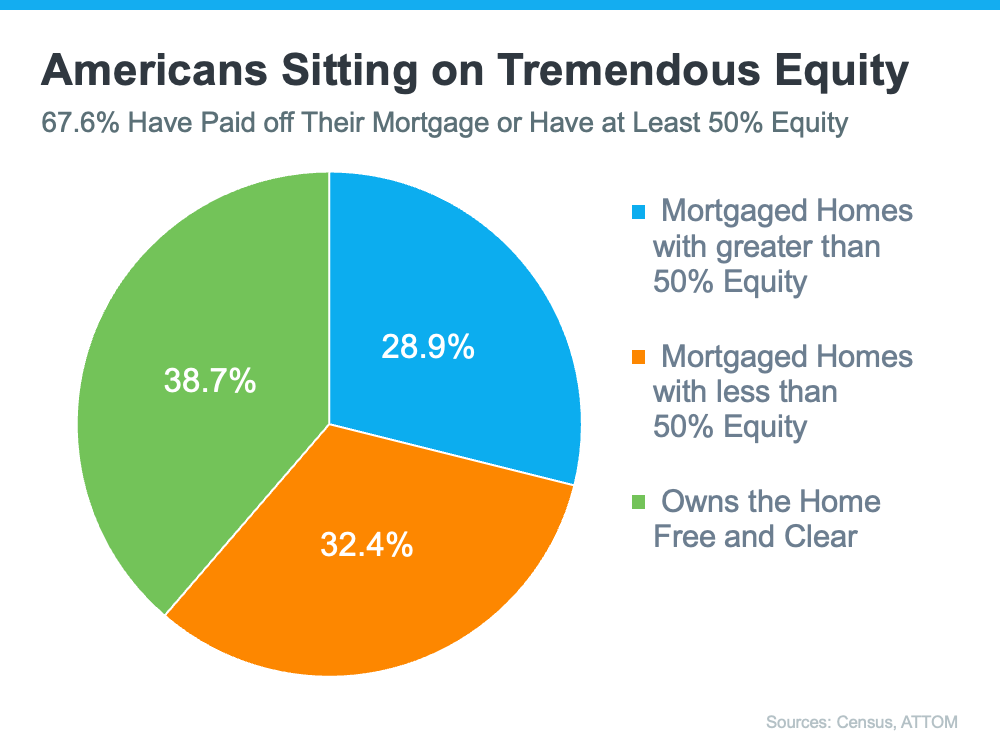

2. The Amount of Homeowner Equity

Second, American homeowners have built up tremendous equity. The Census & ATTOM reports reveal that nearly two-thirds (68%) of homeowners have paid off their mortgage or own at least 50% equity (see chart below):

Equity rich is the term used in the real estate industry to describe the situation today. This is significant because back in 2008, some were forced to walk away from their homes due to owing more than what they were worth. Now, homeowners have built up much equity, which helps avoid another wave of distressed properties hitting the market like before. This creates a strong foundation for the housing market today.

This time, homeowners have built up a lot of equity in the past few years. This helps keep waves of distressed properties from entering the market as we saw during the crash. It creates an incredibly strong foundation for today’s real estate market.

Bottom Line

Homeowners are fighting to keep their current mortgage rates, and they have a large amount of equity. This is why the housing market is so strong compared to 2008. With such low mortgage rates and much equity, homeowners are less likely to default on their loans or walk away from their homes. This helps create a stable foundation for the housing market now, setting it up for success in the future.

If you’re looking for an investment opportunity that’s proven itself over time, real estate is it. We can see this in our lifetime – this real estate market is one of the strongest we’ve ever seen due to low mortgage rates and generous amounts of homeowner equity. These fundamentals work together to create a stable market, helping to protect current investments while opening up the door for future ones. Get ready to make the most of your real estate investments today!