Lending Standards: Then & Now

Homeownership is one of the most important steps to achieving financial security, but obtaining a mortgage can be difficult. In 2004, the Mortgage Credit Availability Index (MCAI) was at its highest level in the years leading up to the housing crash, indicating that it was much easier to get a loan back then. Today, however, standards have changed drastically and the MCAI is now at its lowest level since January 2013.

In this blog post, we’ll explore why lending standards are much different today than they were before the housing crash. We’ll also look at what borrowers need to consider when applying for a mortgage and how they can make sure that they are choosing a safe loan.

You might be concerned that the housing market is headed for a crash, but there are multiple reasons why this market isn’t like 2008. One of those reasons is how lending standards have changed. Let’s look at some data to prove it.

Every month, the Mortgage Bankers Association (MBA) releases the Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is . . . a summary measure which indicates the availability of mortgage credit at a point in time.”

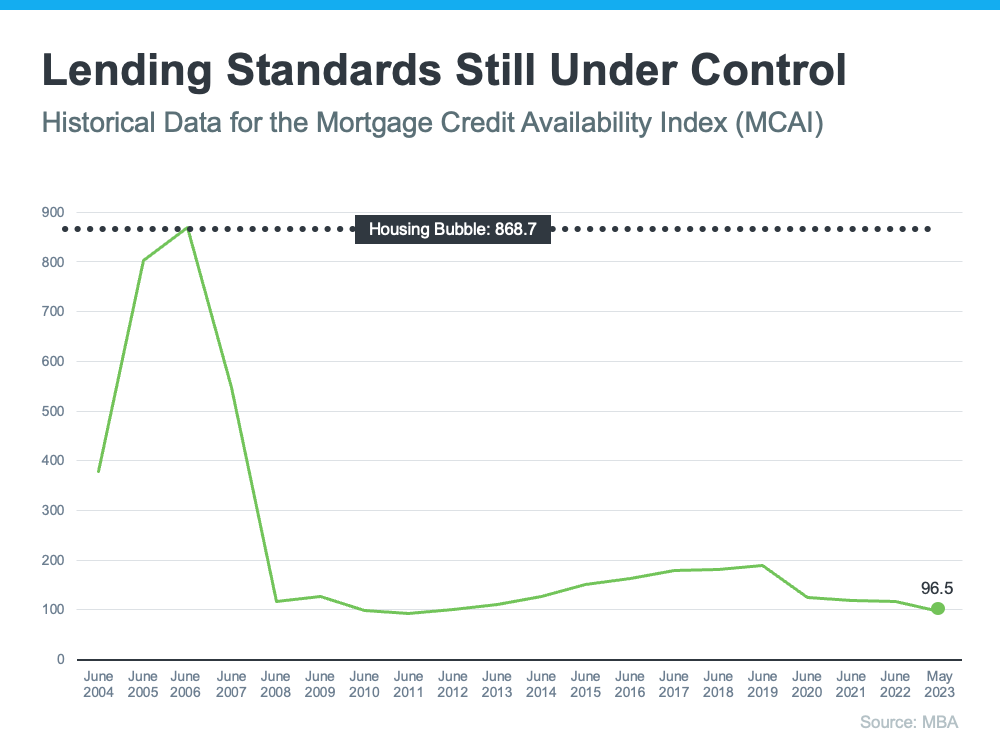

The Mortgage Credit Availability Index (MCAI) shows how easy it is to get a mortgage. The graph below tracks this data since 2004 and demonstrates the changes in lending standards over time.

- When lending standards are less strict, it’s easier to get a mortgage, and the index (the green line in the graph) is higher.

- When lending standards are stricter, it’s harder to get a mortgage, and the line representing the index is lower.

In 2004, the index was around 400. By 2006, it had increased to over 850. Today, the story is different; since the crash, the index has gone down due to tightened lending standards, making it harder to get a mortgage.

Loose Lending Standards Contributed to the Housing Bubble

Realtor.com explains that during this time, it was easy to get a mortgage — even if borrowers lied about their incomes and employment, or weren’t able to afford the loan. This was a major factor that contributed to the housing bubble.

“In the early 2000s, it wasn’t exactly hard to snag a home mortgage. . . . plenty of mortgages were doled out to people who lied about their incomes and employment, and couldn’t actually afford homeownership.”

The peak in the graph shows that before the housing crisis, it was easy to get credit and the requirements for getting a loan were minimal. Credit was widely available and there was a low threshold for qualifying for a loan.

Lenders approved loans without verifying if borrowers could repay them, so creditors were lending to more people who had a higher risk of default.

Today’s Loans Are Much Tougher To Get than Before

As mentioned, lending standards have changed a lot since then. Bankrate describes the difference:

“Today, lenders impose tough standards on borrowers – and those who are getting a mortgage overwhelmingly have excellent credit.”

The graph shows how, after the peak around the time of the housing crash, the line representing the index went down dramatically and has stayed low since. It’s now far below where it was in 2004, and it’s getting lower. Joel Kan of MBA provided an update for May:

“Mortgage credit availability decreased for the third consecutive month . . . With the decline in availability, the MCAI is now at its lowest level since January 2013.”

The decreasing index indicates that lending standards are becoming much stricter. This shows that we have moved away from the extreme lending practices that caused the housing crash.

Bottom Line

In conclusion, it is clear that lending standards are much different today than they were leading up to the housing crash. The Mortgage Credit Availability Index (MCAI) provides a good indicator of how easy or difficult it is to get a mortgage. During the pre-crash years, credit was widely available and qualifications for a loan were not very strict, but now the MCAI is at its lowest level since 2013 and standards are much tougher. It’s important to consider all of this when thinking about getting a mortgage in today’s market.

Overall, it is essential to research your options thoroughly and understand what qualifies as a safe loan before applying for one. This way, you can be sure that you will be able to meet your financial obligations in the long run. Taking this into account can help you make a more informed decision and avoid any potential risks associated with getting a mortgage.