What You Need to Know About Mortgage Rates and Home Prices

If you’re considering buying a home, staying informed on the housing market is important. Pay attention to news stories, social media conversations, and discussions with real estate agents. Also keep an ear out for conversations with friends and family, or even those you hear in public places like supermarkets. Likely topics include home prices, mortgage rates, local housing trends, and other market factors. Staying informed can help you make the best decision when it comes time to buy.

Data can help you make informed decisions and cut through extra noise. Consider these two questions about home prices and mortgage rates as you make your choice:

1. Where Do I Think Home Prices Are Heading?

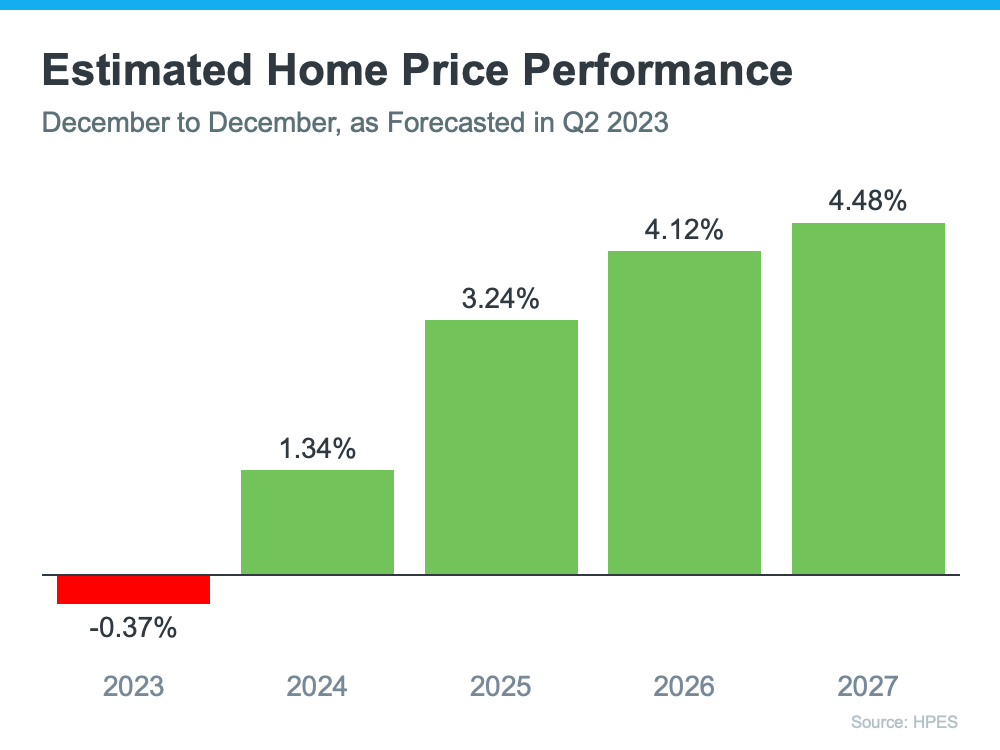

Pulsenomics‘ Home Price Expectation Survey is conducted quarterly and offers reliable insight into both short-term and long-term trends in home prices. The survey’s contributors provide their expert opinion on average home price appreciation over the next five years as well as additional insights into the housing market.

The survey offers a comprehensive analysis of current and future home prices in the United States, and can be used to make informed decisions about buying or selling a home. It also provides data on consumer sentiment related to housing markets, which can help inform real estate investment decisions. By understanding the underlying trends in the market, investors can make better decisions when it comes to buying and selling homes. Furthermore, the survey can help homeowners understand how their homes may appreciate over time.

Experts surveyed are predicting slight depreciation for this year. The worst home price declines have already occurred, and prices are increasing again in many markets. HPES data shows a 0.37% depreciation for 2023 – far from the crash some anticipated.

What Does This Mean?

Overall, the outlook is much more positive than initially thought. The stabilization of home prices has also been bolstered by low mortgage interest rates and increased demand in certain markets. This has allowed for strong investments in real estate despite the volatility of the larger economy. Furthermore, many areas are seeing an increase in home renovations due to homeowners taking advantage of these conditions. As such, investors can be more confident when considering purchasing a home or continuing existing investments.

Looking ahead, the HPES is forecasting that home prices will continue to appreciate from 2021 through 2024. Prices are expected to grow at an average pace of 4.1% over the next three years, reaching an estimated median sale price of $355,000 in 2024. Additionally, this growth could lead to higher mortgage rates. This means it’s a good idea to act quickly before prices and rates rise further.

Why is this important for you? Buying a home now could be beneficial in terms of equity and appreciation. Home values are expected to rise, so you’ll likely gain equity if you buy now. Delaying the purchase will likely mean higher prices, resulting in less overall equity for you. It’s worth considering the long-term implications to make sure you’re making the best decision for your current and future financial situation.

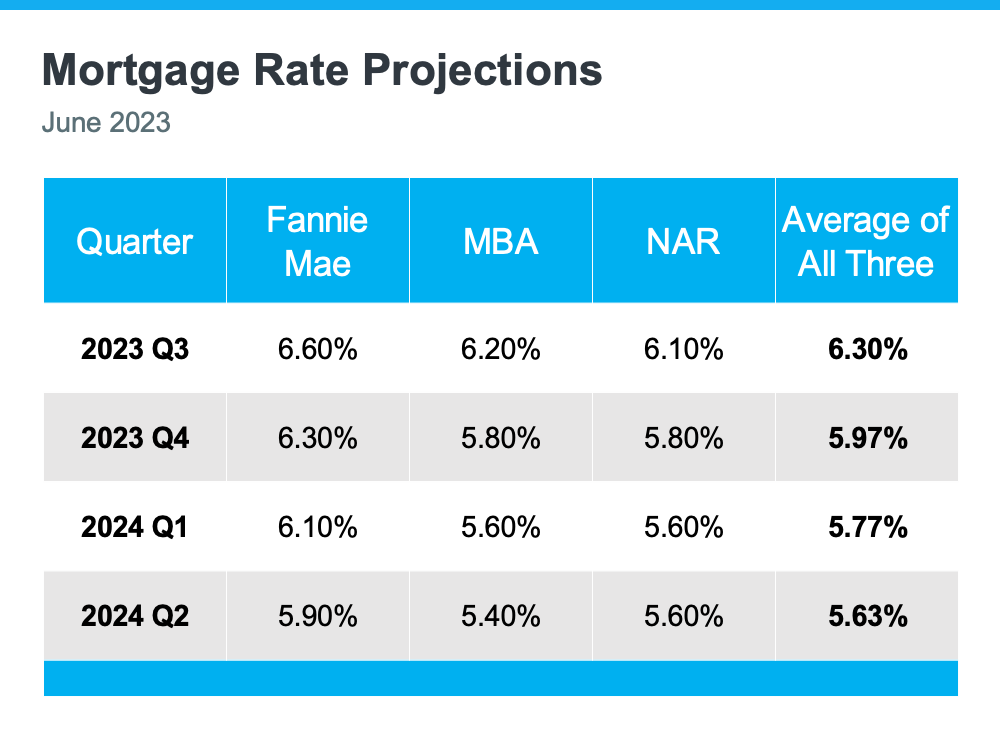

2. Where Do We Think Mortgage Rates Are Heading?

Mortgage rates are closely tied to the federal funds rate, which is controlled by the Federal Reserve. When inflation rises, the Fed raises its rate in order to keep prices stable. As a result, mortgage rates also tend to go up. Since inflation has moderated recently, experts suggest that the Fed will make moves to lower its rate. It is anticipated that rates will land somewhere between 5.5 – 6% on average over the next few quarters. This could lead to reduced mortgage rates, creating more affordable home-buying opportunities for potential buyers.

The economic outlook remains uncertain due to trade disputes and other geopolitical factors. However, the moderating inflation rate gives us cause for optimism that mortgage rates will remain low in the near future. For now, it’s a good time to for you to take advantage of the current rates and start thinking about your home-buying options. Keep an eye out for any updates from the Fed that would affect mortgage rates, and take steps to secure a lower rate if possible. This is a great time to get into homeownership!

Uncertainty is part of the mortgage rate game. Experts can’t predict with absolute certainty where mortgage rates will be next year or even next month. Many factors influence outcomes, such as economic trends and central bank policies. Here are some considerations to keep in mind:

- If you buy now and mortgage rates don’t change: You made a good move since home prices are projected to grow with time, so at least you beat rising prices.

- If you buy now and mortgage rates fall (as projected): You probably still made a good decision because you got the house before home prices appreciated more. And, you can always refinance your home later on if rates are lower.

- If you buy now and mortgage rates rise: If this happens, you made a great decision because you bought before both the price of the home and the mortgage rate went up.

Bottom Line

In conclusion, buying a home can be a complex process with many variables to consider. The most important factors are the prevailing market trends for both home prices and mortgage rates. By gaining insight into these current and projected conditions, you can make informed decisions about whether now is the right time to buy a home and how best to go about it. Use these expert projections and consider all the possible outcomes of mortgage rate fluctuations to ensure you’re making the best decision for your financial future. If you get lost, we are always here to help educate you according to your individual needs.